The #1 Life Insurance Tool To Create Generational Wealth And Protect What Really Matters Most, Your Future And Your Family.

What's more valuable than all your time and all the money you'll ever make?

Your Legacy. What you build and leave behind for future generations.

Our custom life insurance quotes provide a legacy and an everlasting future for your family. More than policies, we weave a tapestry of everlasting memories, ensuring your story lives on. It's not just life insurance for life; it's a melody of reassurance. Let our certified financial advisor team guide you to a future where every heartbeat echoes with love and protection.

Click here now to get the best-customized life insurance quote for your family today.

What Is A Life Insurance Policy?

A life insurance policy offers financial protection for your family when you pass away. In that inevitable moment, there are two deaths: your individual departure, mourned deeply by your family, and the loss of the financial protection you provided. The individual you choose, called the beneficiary, is entrusted with the life insurance proceeds, utilizes the funds as they see fit, ensuring security during this challenging time, both emotionally and financially.

When Should You Get Life Insurance?

You have a need for life insurance when you experience major life events, for example:

- If you were recently married

- You just bought a new home

- You're expecting a new child

- You have others depending on your income

What Are The 2 Main Types Of Life Insurance?

Term Life Insurance

Term Life Insurance is a type of life insurance recommended by experts like Dave Ramsey and Suze Orman because it offers the highest coverage amount for the lowest cost. You pay a little bit of money every month for a specific amount of time (typically for terms of 10, 20, or 30 years), and if you pass away in that timeframe, your family gets a paycheck in the amount of money that you qualified for when you applied for the policy. And if you outlive the term, you could be investing in high quality mutual funds to become financial independent. Click here now to learn more through our "Secret Vault".

Permanent Life Insurance

Permanent life insurance, sometimes known as whole life insurance, universal life insurance, or index universal life insurance, is a long-term coverage plan that lasts throughout your lifetime. According to nerdwallet.com, permanent life insurance provides a death benefit and it contains a savings component in the policy, called cash value, that has the potential to grow over time. However, this is not what we recommend due to the high costs of these policies and the low performance of the savings component.

Life Insurance Through Work Doesn't Count

Work-provided life insurance offers you a small amount of coverage, but it often falls short in meeting the comprehensive needs of your family. According to a study by the Life Insurance and Market Research Association (LIMRA), work-provided life insurance typically provides coverage equivalent to only one to three times your annual salary, which is insufficient for your family (considering your debt, income replacement, funeral expenses, and the rising cost of living). Additionally, coverage ends when you terminate employment or become disabled over 90 days and are taken off active payroll, leaving you without protection during crucial periods. Furthermore, the reliance on workplace coverage leaves you vulnerable, as you do not have control over the policy or the ability to customize it to your specific needs. To ensure robust coverage, experts like Dave Ramsey or Suze Orman often recommend supplementing your work-provided life insurance with a personal policy tailored to your circumstances.

Why Is Term Life Insurance And Mutual Funds The Best Strategy For You?

What you're about to discover is a secret that the insurance industry does NOT want you to know... This secret has the potential to change your family tree forever and create tax free generational wealth.

Now, you have to think about life insurance like you’re buying money. Just like you'd walk into a store and buy some pants, a car, or a product, when you buy life insurance, you're essentially buying money from an insurance carrier. This concept is crucial to understand because what you're doing is transferring risk to the insurance company.

Insurance companies want you to live a long life, as they profit from the premiums you pay over decades. However, if you pass away prematurely, they must pay out a substantial sum to your family. This is where generational wealth comes in.

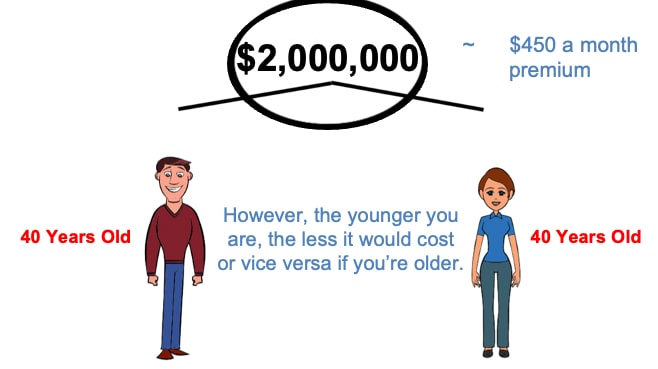

Term life insurance is an ideal tool for this purpose, offering high coverage at a low cost. Let's take an example: a 40-year-old couple purchasing a total of $2 million life insurance policy.

$2 Million for a 40 year old couple typically only costs around $450 per month, which is similar to many monthly expenses like car payment. So, you're essentially investing in your financial future. The younger you are when you begin, the lower the cost.

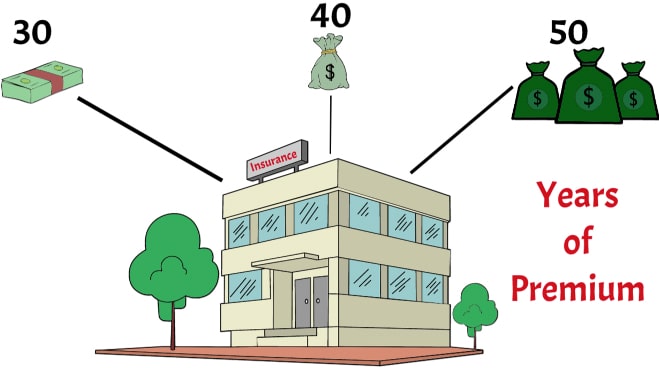

Over a year, you'd pay $5,400 to secure $2 million in money. When you break it down, it's only $15 per day to purchase this substantial financial protection. Moreover, these generational wealth insurance contracts can lock in these monthly premiums for up to 35 years! And other generational wealth policies can last even until age 100!

So, for example, in a 35-year generational wealth contract, you’d spend $189,000 to secures $2 million in money. And according to Harvard University the average adult lives to age 75. If you were 40 years old and passed away at age 75, the insurance company would pay out the $2 million. What's remarkable is that the U.S. government allows life insurance proceeds to be paid out tax-free! That’s a well-kept secret for passing on wealth without incurring taxes.

Using this generational wealth strategy, it’s guaranteed to be profitable! You see, there’s NO investment on planet earth where you put in $189,000 and it guarantees to grow to $2 million. Plus, you’re not taxed on it. Also, you have control; you can cancel the policy if needed, while the insurance carrier can't cancel your generational wealth contract as long as you pay your premiums.

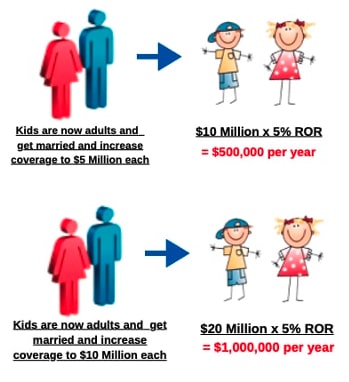

Now, here's where generational wealth truly shines. The average family has two children. The $2 million you pass on to your children can continue growing. If they invest it and only earn a measly 5% rate of return in a mutual fund, they could receive $100,000 annually from the interest alone.

When your children marry and start their own families, they need to increase their coverage to $5 million for both them and their spouse so on their passing they leave $10 million for their kids. Earning that measly 5% on the money and never having to touch the principle, they will receive $500,000 a year! Keep in mind, they will never have to pay the life insurance premium for their coverage because the generational wealth program covers it for them!

Then the process continues, and their kids increase their coverage to $10 million for them and their spouse. They will pass on $20 million to their kids and 5% interest on that will pay them $1,000,000 a year, passing on even greater wealth! See how that works?

One of the common questions people often have is: this is cool but how can I benefit from generational wealth instead of just passing it on... Easy, insurance a family member, or someone who is financial dependent on you. That way, on their passing, you can get a tax-free lump sum of money that you can invest and get your own program started.

And of course, we recommend having a will or a trust so the generational wealth process can continue for generations to come!

In just three generations, you could have children worth millions. This strategy isn't commonly taught, but it's the same approach used by wealthy families like the Rockefeller’s, Kennedy’s and Du Pont’s. Remember, you have control, and this strategy is not only guaranteed but also tax-free. It's a remarkable opportunity to secure your family's financial future and it only works with term life insurance.

Grant & Alyssa C.

Saratogo Springs, UT

I've loved how much peace we have from knowing we're investing in smart ways. Plus, even if, heaven forbid, one of us passes away our kids still have a bright future.

Jeffrey M.

Mesa, AZ

Knowing my family is financially protected means everything to me. They made the process very simple and quick for getting the life insurance my family needed and it was within our budget.

Ryan E.

San Tan Valley, AZ

Thanks to Moon Family Enterprise they made the process for getting life insurance super easy. Knowing we'd leave millions for my kids future makes me feel fulfilled as a parent.

Jen & Carlos P.

Queen Creek, AZ

We've been clients of Moon Family Enterprise for a decade. They have been super patient in educating us on the best financial tools and the personal connection we have with our financial advisor has made it super worth it to be a life insurance client.

Charles & Rachel K.

Orem, UT

Moon Family Enterprise has really taught us the value of being prepared financially. They personally took the time to help us understand the value of life insurance and helped us get a policy so we can leave behind generational wealth just like they teach.

Nate & Casia F.

Mesa, AZ

These guys are super cool and really good at what they do. They've made a million dollar difference for my family and can for yours too. I wouldn't do business with any other company because I know these guys actually care about what they do.

Brian & Linea G.

Clayton, NC

Working with Moon Family Enterprise has been so illuminating. It has taken financial information we never thought was for us as middle class Americans and made it accessible, useful and profitable for our family.

Kate & Adam D.

Kuna, IR

I wouldn't have been interested if it wasn't for the friendship and consistent persistence of the Moon Family Enterprise team. The financial peace is a bonus because I have learned more about finances here than anywhere else.

Travis & Wendy M.

Sacramento, CA

It's nice that the Moon Family Enterprise has become our friends and not just someone we talk finances with. Plus they explain things in a way that's super easy to understand and not high pressure sales talk.

Moon Family Enterprise

Moon Family Enterprise © Copyright 2024, All Rights Reserved.